Quick catalogue guide

Who is the AllCredits catalogue for?

The AllCredits thematic catalogue is completely dedicated to lending. And first of all, it will be useful to those who are interested in lending, who are planning or want to get a loan. On the catalogue pages you will find loan offers with full information, interest rates and examples of loan costs. Also, you will find a lot of additional information about lending, about types of loans, about interest on loans, about bad credit history.

AllCredits is absolutely free for visitors, we do not need your personal data, and we do not have a registration. We do not belong to any financial company and are not financially dependent on any financial or credit company.

What are the requirements for the borrower?

If you decide to apply for a loan, you must meet certain requirements:

- you must be an adult (different credit companies have different minimum and maximum age of the borrower, the catalog contains information about the age restrictions for each credit company).

- you must be a citizen or have a residence permit in the country in which you plan to receive a loan; in some countries, in order to receive a loan, you must permanently reside in this country for a specified minimum period.

- you must have a permanent bank account in the country where you plan to receive a loan, basically the identification of the borrower occurs through bank authorization.

- some lenders require a mobile phone connected to the network

- you need an electronic signature to sign a loan agreement remotely

- you must have an email address

- you must have regular income

- you should not be on the list of debtors (some creditors allow you to have current debts).

- you must have a clear understanding that the loan is necessary, that you will have to return it by paying all the costs specified in the loan agreement.

Can I get a loan in another country?

If you are a citizen of one country and want to get a loan in another country, this is possible if you have a residence permit in another country and an open bank account. Lenders of some countries require you to live in the territory of another country for a minimum period (it is different; it can be 1 year or 3 years). Some countries issue loans to residents of neighbouring countries if they work in their countries. So, for example, in Denmark you can get a loan from Sweden, in Switzerland from Germany. But this is usually an exception and the borrower must meet a number of requirements (for example, receive a salary in the country where he wants to get a loan). Most large credit companies have representatives in many European countries, thus they issue loans in many European countries, but to obtain a loan, you will need to contact a representative of your country.

Nowadays there are many different advertisements, especially on social networks, where loans are offered to anyone in any country. But as a rule, these are not official (not legal) lenders, and most often these are fraudulent sites that will try to take money from you before granting a loan, and frequently after that you will be sent loan offers from your own country, which you can find for free, for example, at our site.

How to choose a credit company?

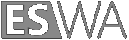

If you meet all the requirements, select the country in which you plan to get a loan, you can choose on the main page of the site or in the site menu. Once on the required page, you will see all available loan offers in the selected country. At the top of the list are quick loans, then consumer loans, then business loans, then long-term loans and finally car loans. In some countries not all types of loans are provided, this is due to the lack of loan offers.

Credits in Sweden | Credits in Finland | Credits in Germany | Credits in Estonia | Credits in Norway | Credits in Denmark | Credits in Netherlands | Credits in Spain | Credits in Poland

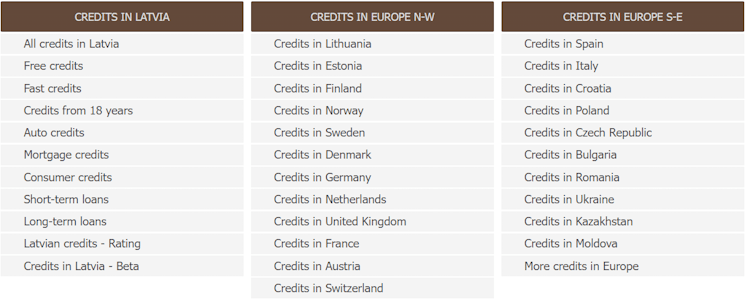

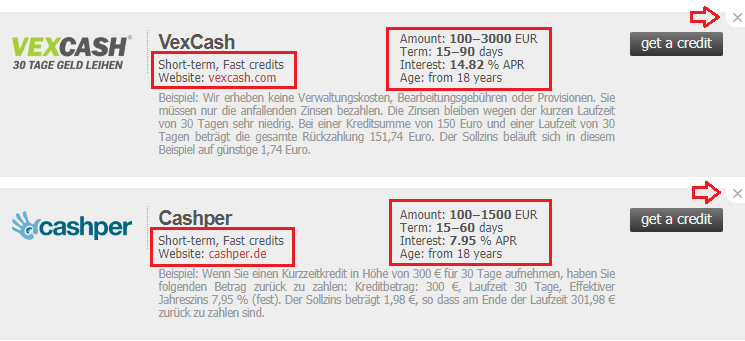

You need to decide on the type of loan that you want to apply for, you must clearly know how much you want to borrow and for how long. For each credit company we indicate the minimum and maximum loan amount, as well as the minimum and maximum loan term. Each advertisement of a credit company has a cross in the upper right corner, by clicking on which you can close the advertisement. Thus, you can close the ads of credit companies that are definitely not suitable for you. We try very hard to place credit companies in the category according to our rating. The rating is complex and includes a number of indicators:

• the success and popularity of the credit company

• competitiveness of loan offers

• how long the company is on the lending market

• the number of successfully completed loans

• customer reviews about the credit company

Analyze the offers of the remaining credit companies; compare the annual interest rate, because the effective annual interest rate is the only criterion by which the cost of a loan can be compared. After the analysis, close more companies that are not suitable for you.

How to get a loan?

After you have several companies left, click on the button “get a credit” from one of them, you will be redirected to the site of the selected credit company. On the site you will need to fill out an application for a loan. You will need to indicate the loan amount, loan term, sometimes the purpose of the loan, and so on. Fill in all the required information and submit your application for review. After that, do the same on the websites of other credit companies, indicating the same amount and term of the loan. The completed loan application does not bind you to anything. Thus, you will receive several loan offers from several credit companies, and you will have an opportunity to choose the best option.

Questions, comments and feedback

We are very grateful to active visitors who leave their feedback, comment on credit companies or ask questions. There is a comment form at the bottom of almost all pages of the site where you can post your review or opinion. If you have questions about the work of credit companies, questions or suggestions for the work of AllCredits, you can contact us in any way convenient for you, all contacts are available on the “Contact us” page.

Latviešu

Latviešu English

English Русский

Русский